Introduction

I’ve been in the healthcare/life sciences/investing world in various capacities for nearly 10 years, and as I explore what is next for my career, I am constantly reminded that I am drawn to writing, nearly as much as I am to investing itself. As such, I am going to be devoting significantly more time to The Borlaug Report this year.

For those of you who have read my past work, this will be both my first paid article, but will have a substantial free component in front of it. If you enjoyed my prior pieces or our conversations, please consider supporting The Borlaug Report with a paid subscription - I’m confident it will be worth your while, especially in the coming months.

Feel free to skip to the JPM section for the free portion of the article if you already have a sense of my writing style/coverage.

What to Expect from The Borlaug Report

For those of you who are new to my work, I’ve left the paywalls off of my older writing (for now) to act as samples. I will likely provide them by request in the future.

I write exclusively about healthcare & life sciences, covering everything but the drugs themselves. I follow both ecosystems closely, following everything from US healthcare policy to what big pharma is doing globally, trying to flag interesting trends, deep-dives on ideas that merit them, and to take sides on areas of debate. Coverage will include:

Life sciences:

Traditional tools

Bioprocessing

Injectables

Contract research organizations (CROs)

Contract development and manufacturing organizations (CDMOs)

Global macro and policy changes

Healthcare:

Medical devices

Diagnostics (including genomics)

HCIT

Hospitals & other providers

MCOs/HMOs

Distributors

Other healthcare services (distributors, etc.)

US & other healthcare policy changes

Other:

Commentary on developments in megatrends that push outside healthcare

Healthcare-adjacent sectors such as vet or dental

Updates on how AI/LLMs is impacting healthcare and life sciences

I will be covering spaces and names that are investable to a mid-sized institution or larger. I am happy to consider discussing small-cap or micro-cap names in free articles or privately.

I plan to write a combination of commentary on current developments, primers, and deep dives/stock pitches. and tend to be style-agnostic (perhaps with an underlying bias to quality). I always welcome feedback on what to write about next. My first few articles will be focused on updating my previous work on bioprocessing, starting with Repligen as I believe the thesis has evolved dramatically.

I tend to gravitate toward situations where big changes in innovation, macro behavior, or policy is changing things when deciding what to write about. There aren’t always big changes to discuss, but there are never shortages of company-level debates either - you’ll see this publication zoom in and out depending on what is topical.

I’m always open to feedback and suggestions on where to take the next article or how to prioritize, and love to discuss/defend my work/answer questions on what I’ve written. I’ll generally comment on my plans for the next 2-3 articles at the end of each, so please feel free to let me know if what’s coming next strikes you as boring!

The current game plan is to write 1-2 paid articles per month and 1-2 free ones per quarter. I’ll do my best to strike a balance in the pre-paywall sections for those who don’t have the appetite for the paid version as well.

For the rest of the year, I am planning on writing a more in-depth primer on bioprocessing, as well as a series of deep-dives and pitches on names I think are topical in the broader life science space. I will run the same playbook with primers on managed care, hospitals, medical devices, and diagnostics, mixing in deep dives and pitches on various names worth mentioning.

My first paid article will be a long-form pitch on Repligen, which I have written a deep-dive on in the past. I have owned the stock on-and-off in the past, but currently view it as one of my best long ideas in life sciences for the next 12 months. I believe that bioprocessing as an industry is returning to its secular growth trajectory in 2025, but that there will be relative winners and losers, with Repligen being one of the former. I’ll talk at the end of the article about other such winners.

Before I go into the Repligen thesis, I figured it made sense to go over the obligatory JPM week recap from the perspective of a non-therapeutics analyst, as well as comment a bit on bioprocessing more broadly.

JPM Week Recap

The sell-side always does itself a disservice writing its year-ahead outlook pieces just weeks before this conference. As far as JPM weeks go, this was one of the more “standard” ones, but there is definitely a minimum amount of new information we get at the event that always informs how things are going. As always, we got enough pre-announcements, guidance, and commentary to completely change some of the writing the large brokers did in December/early January.

Life Science Takes: 12-Step Program for R&D Recovery

Most of the sub-sectors in life science are eagerly awaiting signs of recovery. At JPM, we didn’t exactly see fireworks, but we did get a window into how things went in 4Q. Unfortunately, there wasn’t much confidence to go around in terms of the path through 2025.

Traditional R&D tools definitely got some form of budget flush in 4Q. This was confirmed primarily by pre-announcements at RVTY, BRKR, DHR, and TXG, among others. All seemed consistent on the notion that the benefit of seasonality was a little better in 4Q24 vs 2023. In 4Q23, we didn’t really see one at all.

However, R&D end market visibility still seems to elude most of the space. In R&D There are effectively 3 sources of demand: big pharma, small-mid-sized biotechs, and academia. While performance was lackluster across the board in 2024, and confidence remains hard to come by despite some good pre-announcements, it’s likely going to be important to stay cognizant of what drives these 3.

Pharma is still belt-tightening. While there weren’t as many instances of “reprioritizing” as we saw last year, the plans set in motion last year were multi-year in nature. One new example that stood out this year was Biogen. At JPM, the company didn’t say much about its spending plans, but pointed to its success in improving margins via cost of goods. A week later, the company reportedly embarked on a large restructuring of its R&D division, cutting resources “outside of its focus areas”.

In 2024, biotech funding was up ~40% y/y, albeit of a trough 2023. Even if pharma was tightening its belt, you’d have expected this recovery to benefit the space. However, we learned about halfway through the year that capital market-dependent biotech was making funding last longer than in the past (1 year of funding is now 2 years, etc.). Funding is challenging to predict because of how early biotech companies go public and how fluid the movement of dollars in and out can be to that segment of public markets.

To take an optimist’s point of view on biotech, this would imply that most of the space is already funded for at least flat R&D in 2025, and any funding we see would be far more incremental to near-term spending than in prior years. Not crazy to think a few % y/y increase in funding could support mid-teens biotech R&D growth.

Academia was no better in 2024, but might be better than meets the eye in ‘25. Globally, 2024 academic spending was a disaster made worse by continued declines in China. Now, the US is faced with uncertainty around NIH funding, including the latest headline freeze. As a reminder, the NIH makes ~half of US grant funding. Luckily, the other half of the US is generally a lot more stable (probably grows in 2025) driven by institutions with market-indexed foundations behind them, and the US is only part of the total pie. However, there is one interesting nuance Deutsche picked up in a survey that might support some optimism:

Uncertainty and/or disruption over the past couple years appears to have prevented academic labs from spending their entire budgets. While it’s not clear if these predictions will be accurate, even spending 95% of a flat total budget in 2025 would drive ~HSD% upside. Could be a welcome relief if the biotech/pharma markets don’t show support.

Bioprocessing recovery is upon us but the debate is now the magnitude. Most of the bioprocessing-facing companies presented at JPM, and the tone was one of “everything is going as expected” in 4Q. Danaher’s commentary actually sounded like things were tracking to the low end of plan on revenue in 4Q (they called out outperformance in their biotech segment form the non-bioprocessing part with the whole segment in line), but orders/book-to-bill will probably remain the only thing that matters during earnings this quarter. I’ll talk a lot more about everything I think is happening in my next article.

Healthcare Takes: Utilization, Products, and Office Politicians

I’ll keep the healthcare section brief in an effort to keep the focus on life sciences/bioprocessing/Repligen - most of the biggest developments took place outside of the event itself:

CMS published its Advance Notice for 2026, with an expected average change of 4.3%, or 2.2% excluding risk score trend - investors were expecting that this number would be as bad as flat or even negative. This is a huge positive for Medicare Advantage-heavy insurers such as UNH, CVS, and HUM. As better rates on (hopefully) stable utilization support long-awaited margin expansion.

UNH reported earnings, with a weak medical loss ratio, partly driven by 1-timers, maintaining its 2025 guidance. One source of weakness was Medicaid redeterminations as seen in prior periods, and ELV reported this past week with similar remarks.

During his hearing, Scott Bessent claimed that Trump said Medicare would not be touched in his efforts to cut/optimize government spending - this was good for Medicare, but when pressed on Medicaid, saying he was in favor of “empowering states” but that it was Congress’s job to decide the budget.

Since JPM, we have also seen earnings releases from JNJ, ISRG, HCA, ABT, among others. The takes all seemed to support the idea that utilization is roughly in-line with where everyone is expecting. Overall, this sets the stage for a fundamentally “normal” 2025 for payors, providers, services, and medtech companies, but political headlines will likely move things in a way that would have investors thinking otherwise.

Why Bioprocessing Sucked in ‘24 and Why It’s Still Better Than Tools in ‘25

My primer on bioprocessing outlines why the industry is attractive to long-term investors, and I later took at stab at explaining the transition period the industry was going through in my deep-dive on Repligen. I explained the dynamics as follows:

COVID demand evaporated faster than expected (‘22, ‘23).

CDMOs were left with inventory from COVID production they expected to be doing (‘22,’23).

A high portion of the 2020-borne startups and/or clinical candidates cease to exist, removing CDMO demand from this segment of the market as well (‘23).

Mid-to-large-size biopharma companies also got lean by removing non-core programs, leaving them with excess inventory if they had manufacturing or process development in-house. (‘23)

Based on this knowledge and survey data from a couple different providers, I was of the mind that 1) destocking would complete near the beginning of 2024, and that 2) we would see a gradual recovery thereafter.

So why didn’t we get a recovery? We actually already did get one. It’s just not visible to the naked eye because “recovery” was myopically focused on the attractive part of bioprocessing businesses - the consumables. We ignored razor sales out of excitement to see the blades recover.

The first signs that we were exiting destocking appeared in 1Q24, with the bulk of customers completing in 2Q/3Q, a quarter slower than hoped. However, organic growth was fairly negative in the first half of the year.

Destocking took longer because of clinical market weakness, both from big pharma further cutting costs, and biotech stretching funding despite funding growing 40% in 2024. Some expected China to recover in the second half, and that obviously didn’t happen.

However, the clinical market slowness was just a minor source of pain.

What make bioprocessing painful to own for a third straight year was capital equipment. Most popular bioprocessing companies earn between 15% and 25% of revenue from equipment revenue, and each fell victim to a capex hangover in 2024.

To make matters worse, disclosure of quarterly bioprocessing equipment is weak - Sartorius and Repligen only give mix annually, making it challenging to quantify exactly how much equipment revenue landed in a given quarter. Danaher gives recurring and non-recurring revenues quarterly within its Biotechnology segment, but doesn’t break out how much is Bioprocessing vs Discovery & Medical on a quarterly basis, and allowed many customers to cancel orders in 2023. The sell side doesn’t model on recurring vs non-recurring at all for this reason.

This created a setup where 2024 was marked by a small and gradual recovery in consumables completely offset by a big enough drawdown in capital equipment to be meaningful despite mix. The upside drivers didn’t show the upside we’d hoped for, capex did much worse than most imagined.

This was unfortunate, but actually goes the distance in validating the longer-term bioprocessing thesis. The remaining debate is whether capital equipment will ever grow again, which I think is silly.

All told, bioprocessing endured some disappointments that were industry-specific, but also ones that shared drivers with the broader life sciences space.

Based on my conversations over the past year, it’s clear that investors started to conflate bioprocessing and more traditional tools companies again, but going forward I think the difference could be massive.

Why Secular Trends Favor Bioprocessing: COGS vs Capex vs Opex

If you ran a pharma company and had to increase margins, what would you cut first?

It’s starting to seem likely that we get at least some growth across all of life science tools. However, the risk that is forming is that investors see this as a recovery that ultimately leads to the long-term growth of old.

Many investors see the entire life science space as a secular growth industry, but the drivers of each are different in a way that will be a key nuance over the next few years. My prediction for the next 12-24 months is that 1) The recovery will ultimately be a disappointment for certain traditional tools companies and 2) Bioprocessing will re-emerge as the most attractive vertical in life sciences in 2025.

The growth of the entire life science tools space space ties back to some combination of:

Biopharma R&D

Academic spending

Industry capex

Biopharma COGS

The truly secular drivers of life sciences/healthcare are aging and chronic disease. Downstream, this means secular growth in the total amount of healthcare services and products consumed per person. As such, the only truly secular growth happening in life sciences is on the total volume of drugs sold by biotech and pharma.

Biopharma sales aren’t even inherently secular on a product level without new drugs being brought to market - pricing collapses once generics/biosimilars compete with legacy drugs.

The reason these have all appeared secular for so long is because under normal conditions, pharma and academia globally have grown spending in what has appeared to be a secular fashion. However, at the end of the day, R&D and capex are both areas for which there needs to be an ROI, especially at big pharma, even more so when sales growth is challenged. Below is a useful way to look at big pharma R&D spending without the bias of a more positive slope:

Source: UBS

R&D as a % of sales grew from ~15% of sales in 2013 to almost 20% a decade later. Put differently, increasing R&D as a percent of sales added 3% to long-term R&D growth at big pharma. But you can’t do this forever. Would you invest in a business that compressed its own margins into perpetuity? There needs to be a return on this type of investment.

When sales growth is plentiful and no one is scrutinizing return on spending, this tends to get lose in translation. At the same time, however, there is mounting evidence to suggest that IRRs on pharma’s R&D spend, at least at the late-stage end, has been plummeting.

To make matters worse, a lot of pharma IP is expiring over the next 5 years.

Total US pharma sales in 2024 was ~$640B, up from $600B in 2023 (+7% y/y), and estimates see 3% growth in 2025. The red bars in the Evaluate chart above show how much US revenue is associated with patent expiries, and every $20B is about 3% of sales, roughly half of which is expected to materialize in actual loss. Lower prices create margin pain.

The UBS chart above, which aggregates consensus estimates, suggests that the industry is returning to pre-COVID levels of R&D spend as a % of sales. But why would it necessarily stop there? Both UBS and Charles River seem to expect that big pharma R&D will grow with sales after reaching pre-pandemic levels, but the industry could feasibly go back to historical levels around 15% of sales, focusing on M&A to bring in new shots on goal and revenue (which optically adds to big pharma R&D but creates a negative net effect which considering the total dollars given synergies).

Globally, estimates have big pharma growing at a 6% CAGR over the next 4 years. If consensus is right on the % of sales being spent on R&D by 2026, it presents a ~3% headwind to big pharma R&D growth, which is logically how you bridge to Charles River’s estimates. This is only a base case today.

However, if we went back to the much longer-term level of 15%, it would present a 6% headwind over 4 years. This would effectively wipe out all of big pharma R&D growth, which is almost 70% of all biopharma spending. For the industry to grow 5% in this framework, the remaining 30%, much of which depends on funding, would need to grow at a CAGR of nearly 17%.

Unfortunately, funding growth likely can’t sustain high-teens anymore. Funding growth has run at a 7/9% CAGR over the last 5/7 years leading up to 2024, down from 10%/18% in 2019.

This is all to say, you’d likely need another funding bonanza and sustain it to reach that level. If the industry holds a 9% growth CAGR going forward, the total biopharma R&D market would grow 2.7% through 2028. At 5% CAGR, growth decays to 1.5% on a blended basis.

The popular large-cap tools companies all have 40-60% exposure to biopharma as an end market, which the above analysis shows could actually be growing 2-3% when investors expect 5%+ organic growth from compounders in any sector. The rest is a mixture of academia, diagnostics, and industrial end markets, none of which grow faster than 6% in a good year, with academia and industrial bringing cyclicality to boot. The large tools companies are great businesses, but if this risk materializes, they are great businesses in an abysmal zip code.

Is Life Science Tools Really That Bad?

The short answer is no, but the real issue is that they are unlikely to appear as great over the next 10 years as they did in the past 10 years, and that’s not what valuations call for today. With the bear case out there, it’s important to mention the nuances.

The best counter arguments to the above effectively makes my point for bioprocessing:

Not all biopharma exposure is created equal - not all are fully levered to R&D. Why not focus on the companies that are less levered to R&D or are levered to the parts within R&D that have other growth drivers?

There are great examples everywhere - academia and pharma basic research are focusing more on proteomics, GLPs are outgrowing other therapeutics, etc.

Earlier I made the distinction between pharma R&D, capex, and COGS. I picked on pharma R&D because it is the largest single pocket of spending as a % of pharma sales that isn’t tied directly to drug volumes. However, capex doesn’t fall perfectly into either category - it depends heavily on what the equipment is used for.

Some instruments, like an electron microscope or a high-end mass spectrometer sold by Danaher or Thermo Fisher, are very much used in pre-clinical R&D work. In contrast, liquid chromatography-mass spec (LCMS) is also sold by a handful of tools players and is used in quality control. Some instruments, such as the gene sequencers sold by Illumina, are even used for diagnostic healthcare applications.

The reason this matters is because then instruments sold in quality control are not optional - if you want to make more of a drug, you need the capacity to manufacture it and perform quality control. Unless the rate at which an instrument can do its thing improves, or the rules change on how many samples you have to check, you need a 1:x ratio of LCMS instruments for a certain amount of drug. When a QC instrument needs replacement, one must replace it. You can’t discontinue using it or switch to a different tool to analyze for the same things like you might in basic research.

This is already a great starting point for a pharma growth algo, but even more so when you consider that the highest-growth category in all of biopharma, GLP-1s needs a LOT of LCMS. To effectively ensure high quality substance of a peptide, LCMS is currently a go-to method, which has already benefitted companies like Waters.

The real stars in life sciences, are companies who most closely resemble the “COGS” of biopharma. Contract manufacturers are an obvious one, but within tools they are fill-finish companies such as West and Stevanto who make the components for the drug delivery devices themselves, and bioproduction companies, which I’ve probably beaten to death. The companies are attractive because they attach directly to volumes - price gets passed through and is a small % of the total cost of production. This allows COGS players to more closely and reliably mimic the aggregate of industry sales.

The last dynamic is the same: new drug discoveries are increasingly being done on larger, more complex molecules, which are made using bioprocessing equipment. This adds another layer to an already-secular growth pattern.

With that in mind, I want to share some updated thoughts and my thesis for Repligen, my top life sciences idea for 2025, with you. Since I’ve written a lot about the company and industry background in the past, I’ll be focusing on what has changed and what’s ahead.

The ultra-short version of Repligen’s background is that it is 1) A pure-play bioprocessing company that 2) innovates to outgrow its larger peers with 3) a product portfolio that doesn’t overlap much with peers, supported by 4) an excellent management team.

Repligen 2.0 - New Developments, New Thesis, Best Growth Idea in Life Sciences

Note to reader: I am heavily referencing my previous writeup on Repligen here, and discussing what happened since. If you are an investor that keeps current on the bioprocessing space, I’d recommend skipping to the thesis section. If not, I’d recommend starting with my primer on the broader industry.

I am a “growth investor” at heart, but where I am different from the average growth investor is that I don’t screen on growth at all - I am looking either for upside potential to numbers or lack of downside potential when I believe there is enough fear priced into a name (which can often produce a lot of “value” ideas). I gravitate toward situations where positioning is on my side, and I think that’s the case here (RGEN sports a 6% short interest ratio and was the top-ranked SMID short idea in a December buyside survey for life sciences).

Part of why this has worked well for me is because it exploits short-term positioning and sentiment with a long-term horizon which I feel many longer-term investors still neglect today, partially due to institutional factors. Since positioning is so hard for most to quantify (I’m sure Citadel has this figured out), it can create situations where investments work before a thesis is proven/disproven, or even if the thesis is ultimately “wrong” by smaller magnitudes because the positioning move is larger than the downside that materialized. This obviously works best when one gets both the positioning and the forecasting right, but the real de-risking occurs when you can identify a large gap in either.

When I first wrote about the business 2023, I owned Repligen for “lack of downside to numbers”, thinking that we were ~1 round of negative estimate revisions away from the end of all of bioprocessing’s woes, and that Repligen would show the most torque to the upside. We did indeed get one more round of revisions to 2024 estimates, with an (11%) cut to 2024 estimates taking place the subsequent earnings season. By its 4Q earnings release on 02/22/24, Repligen had moved by as much as 24% from the day I wrote to its peak, and 84% from its trough.

I probably could have timed the article better (a month sooner would have added another 25% returns had you invested the day of the article, ~2 months later could have captured the October bottom for an even better outcome), and without an updated view, wasn’t even right about the downside - revisions of another ~(5%) have hit since then, which is meaningful when it starts to drive estimates down to unspectacular growth levels. I’m actually satisfied with how I executed the trade personally (I was struggling to make model numbers work in the 200s at the time), but it’s beside the point - let’s assume that the buy side was expecting the first downward revision to 2024 revenue starting on 08/11/23. Just the trading range alone since then has been a 20%+ band for a business where the estimates only revised another ~(5%). From technical support (which I don’t love but others use) to peak, there was a 50%, 10 times the size of the fundamental stakes, all for a business I still believe to be a secular long-term growth story with a reasonable valuation. That’s positioning in a nutshell.

The above was all a long-winded explanation of how I thought about the first decision to own Repligen, at the risk of sounding like I am justifying my way out of being wrong. The reality is that both the positioning and the outlook moved a lot last year.

I’m saying all this because this thesis is no longer about being there when things stop getting worse. I own Repligen today because I see significant upside potential to estimates that few seem to be aware of today . This is likely true because 1) interest in bioprocessing is practically at a local low and 2) Repligen screens as “expensive”, leading most investors to prefer optically cheaper alternatives.

Heading into earnings late last year, I had the view that bioprocessing (meaning the whole space) would return to its pre-existing secular growth trajectory, that estimates were in a safe place, and that 3Q would be the point at which investors finally realized we were “done” catching falling knives.

Ironically, unless you looked exclusively at single-day moves in Sartorius and Repligen stock on their earnings prints and ignored everything that happened afterward, you’d think I was wrong through the end of the year based on stock price changes. Prints for all major players’ bioprocessing exposure were ~in-line, but we got some positive book-to-bill surprises at the pure-plays, and more importantly, no real cuts to guidance for the remainder of the year.

However, there were still subsequent revisions to FY25 estimates. The sell-side shaved off another 1-2% from Repligen’s 2025 revenue estimates after what I thought to be a solid (if not thesis-changing) print from the company.

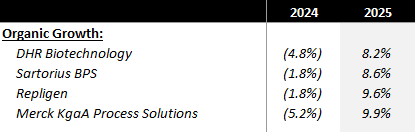

Dynamics were similar for peers: bottom confirmed, but now caution is being injected into recovery assumptions. That aside, 2025 consensus estimates for bioprocessing now look a little silly when compared to each other:

Needless to say, I think the banks overshot. Historically, Repligen has enjoyed above-industry growth, trailed closely by Sartorius, with a much tighter cluster for the rest. This is because 1) single-use technology penetration adds to growth 2) higher clinical exposure generally supports higher long-term growth, and 3) Repligen has repeatedly proven itself the innovator in the space, launching and iterating on meaningful products almost every year.

So why should 2025 be different? One of the arguments I’ve heard supporting consensus estimates is that growth rates converged a lot in 2024. However, the drivers of growth for each of the 4 quoted above (as well as Thermo Fisher, Avantor, and the smaller players) are so different that I don’t think recent history is useful. In fact, it just merits a deep-dive into why some were better or worse than you’d normally expect in 2024. I think I have some answers for each, which I’ll write about in my next article.

Repligen reported 3Q24 numbers late due to its restatement to properly re-assign revenues from a COVID cancellation to the proper quarters. In the midst of peak election drama, Repligen beat revenue estimates by ~1% and reported a book-to-bill above 1.0x for the 5th time in a row.

This was obviously welcome news, but a comment that management made on its 3Q24 call caught my eye and led me into a rabbit hole that has me extremely excited about the next 3-5 years.

Having spent the last couple of months diving deep into certain questions, I believe I have an enhanced understanding of what is going on and am excited to share these learnings, beginning with the company I think is best-positioned to capture the benefits of change.