Introduction

I felt weird writing about Avantor a few months ago. It was a name I knew well from following it for several years, but it felt phony to write a piece covering the business and why I didn’t own it. As such, while I’m sure I’ll write on names I don’t own again in the future, I’ve been waiting to write about Repligen until I’d gotten long myself. I got greedy waiting for it to get “cheap”, and ultimately ended up buying it the morning of Sartorius’ 2Q23 earnings, effectively conceding that I’ll probably never get the chance to own it at a low optical multiple (even pre-guidance revision).

There have been lots of examples of companies with high-growth algorithms that were never really cheap until it was obvious they’d be expensive a high percent of the time, especially in healthcare. There is a DCF rationale for these higher-multiple names - plug in an extra 5 years of double-digit sales growth into a DCF before the “decay” to GDP growth everyone puts in and you’ll see what I’m talking about. Most prefer the simplicity of the best-of-both-worlds GARP names, but this is an example of one I’d feel comfortable taking high-multiple risk on.

Given my excitement about bioprocessing and its future as an end market, as well as Repligen’s likely place within that future, I’ve taken a slightly more aggressive stance and added it to my list of set-it-and-forget-it holdings.

PM Summary

Industry: Bioprocessing is a segment of the life science tools industry that is effectively the cost of goods for large molecule drugs such as antibodies or cell/gene therapies. It is an attractive end-market that I expect to growth 10-12%/year for the next 5-10 years.

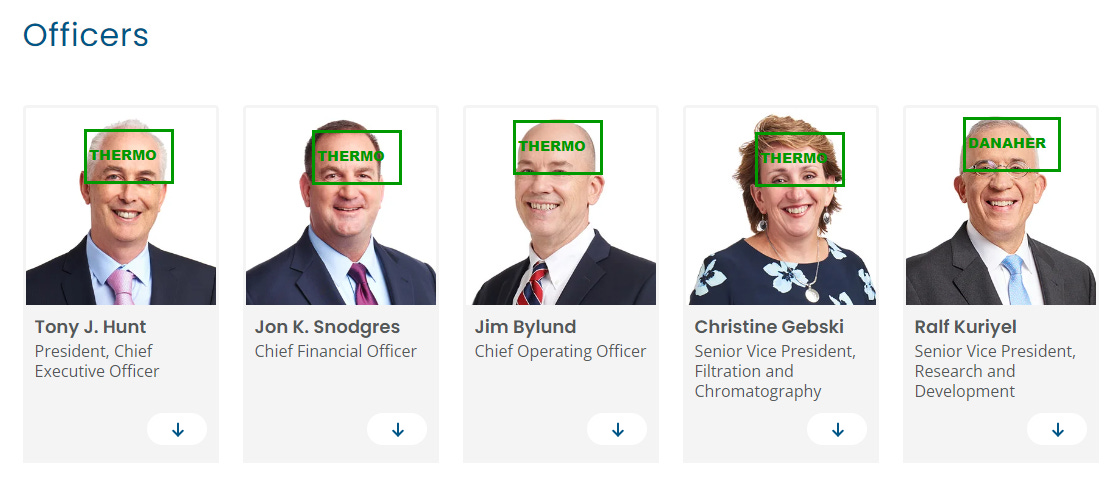

Company: Repligen is one of a small number of liquid, profitable pure-plays on bioprocessing with a best-in-class management team that hails largely from Thermo Fisher.

Why it’s special: Beyond its top-notch management team, Repligen has a track record of being the only real innovator in bioprocessing equipment of size, launching new products every year that serve the emerging micro-trends within the industry better than any of its peers. It already enjoys monopolies in several such niches. I expect it to be a disproportionate beneficiary in biosimilars as well as cell and gene therapy production over time.

Why the opportunity exists: there are 2 key reasons why Repligen is an opportunity today despite a high optical multiple:

The explosive growth Repligen has already enjoyed from non-covid sales in 2021/2022 likely comes from massive share gains in clinical programs that are now locked in and can support significantly above-market growth over the next 5-10 years.

The investors on the sidelines are likely under-estimating the degree to which Repligen is under-earning.

Recap - What is Bioprocessing & Why is it an Awesome End Market?

I think I covered the ABC’s in my bioprocessing primer, but to recap:

What is bioprocessing?

Bioprocessing (sometimes referred to as bioproduction) is the manufacturing process behind large molecule (biologic) drugs.

The process is actually conceptually simple - the “drug” itself is a bunch of cells. In Bioprocessing, you’re trying to manufacture lots of cells. That’s it.

Cells multiply. To manufacture them at scale, you put them in a bioreactor (a vat) with a soup of what are effectively growth hormones and the right temp/oxygen conditions. The cells do the rest of the work. This is called “upstream bioprocessing”.

After you have your soup full of cells, you need to isolate the cells. The downstream half of bioprocessing is largely around making this happen by using various machines to filter the cells out without compromising them.

The cells then get put in infusion bags, pre-filled syringes, or syringe vials depending on how the developer chose to deliver the drug.

In the past, drugs were mostly small molecules (aka chemicals), and were much easier to make at scale. The manufacturing cost of goods was largely headcount, sterilization chemicals, and utilities. Given the number of steps in bioprocessing, however, there are lots more instruments involved, and consumables that can be sold into the process.

Why the industry awesome:

Pharma drug sales as a total grows 3-5% per year in aggregate, as do the cost of goods sold.

Large molecule drugs (dubbed “biologics” by investors) are becoming an increasing share of these drug sales, as well as an increasing % share of total pipeline assets (~25% -> >40% over the past decade). The IRA will likely push this trend further if not repealed/amended.

The production of many biologic drugs, especially for smaller patient populations, steers more of total production spend to tools companies as a % share of COGS (vs utilities and chemicals).

Together, these factors, among others, support industry growth of ~10-12%.

Most of the consumables sold into bioprocessing get locked in via FDA filing (“spec’d-in”), creating stickiness with pricing power.

Aside from being a pure-play on this enticing industry within life sciences, Repligen is an emerging leader in this space, as well as a skilled consolidator of smaller assets in the space. One more note I’d add is that downstream bioprocessing tools are a more universal beneficiary of all large molecule drug success. Repligen fits perfectly within this mold as well.

Company Overview

Repligen has been around for a while - the company was founded in 1981 as a small pharmaceutical and tools conglomerate, but the story really gets interesting in the late 2000s/2010s. This is because the company started to streamline its identity to that of a pure tools company, licensing out its therapeutic candidates from 2008-2014 and acquiring assets that are used in the production of biologic drugs. Things continued to get better when Tony Hunt, the current CEO, stepped into the company as COO in 2014, quickly rising to the top the following year.

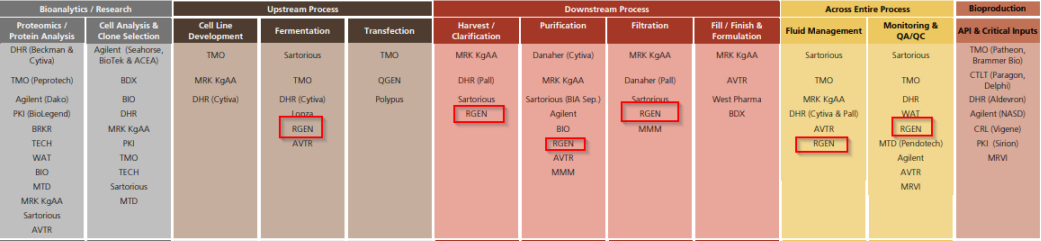

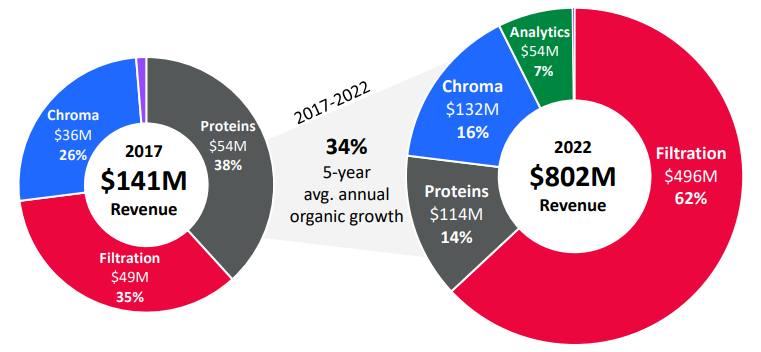

In its life as a tools company, Repligen originally got most of its revenue selling protein A, a component of the “soup” that goes into a bioreactor. Via M&A, the company added filtration and chromatography assets, both of which have made it an extremely competitive business. Acquisitions continued, and Repligen today has product offerings in just about every step of the downstream bioprocessing, as well as some assets that cater to upstream in addition to its proteins business.

Financial Overview in 5 Charts

I’m going to steal some charts instead of talk at length about Repligen’s financials - these are from RGEN’s analyst day back in May:

SAM/TAM (~$20B across all categories growing ~LDD):

Historical Growth:

Capital Vs Consumable:

Customer Base:

Margin Profile (Misleading- See Valuation Discussion):

Repligen’s Competitive Edge - Better Products, Better Positioning, Better M&A Execution

I’ll spoil the ending: you need to believe Repligen will continue to outgrow its peers in order to be profitably long the name. If you don’t, there’s no point in owning this over a basket. Bioprocessing is awesome, after all.

I happen to fall into the believer camp. Repligen has demonstrated repeatedly that it knows the emerging micro-trends in bioprocessing and how to execute on M&A without overpaying, while iterating on existing products in a way that its peers seem to be failing to replicate.

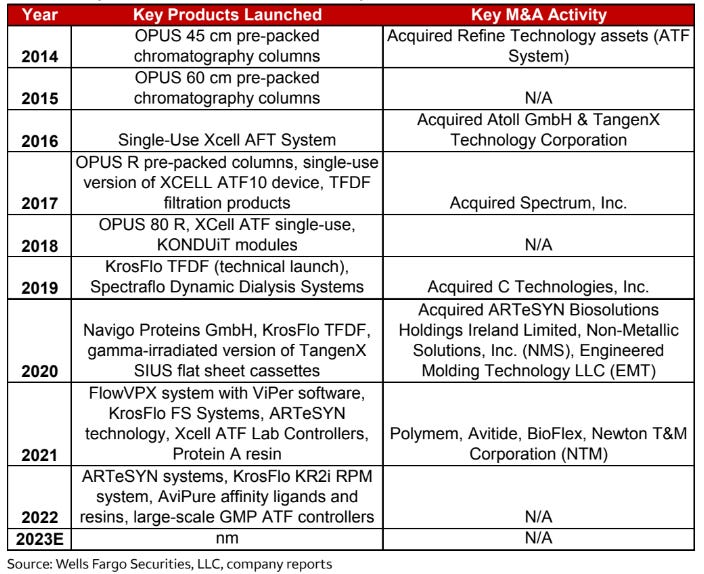

One need only look at Repligen’s history of key new products and M&A side-by-side:

The Products that Put Repligen on the Map

Repligen has a large product suite today, but there are a few products that help it separate itself from its peers. In fact, it’s probably the only company that is constantly putting out new products every year in bioprocessing.

Some of this is a function of the equipment Repligen sells - hard to innovate on the upstream bioreactor and/or bag if you’re Sartorius. This is by design and a key reason I think Repligen is poised to become and stay a big winner in the next wave of industry growth.

While I’m sure others might disagree, I’d boil the ones that have driven and will drive Repligen ahead of peers competitively to the following:

Opus Pre-Packed Columns

Repligen made a name for itself in chromatography with pre-packed columns, which it continued to improve upon with the help of its acquisition of Atoll in 2016. In chromatography, one runs the cells and media from an upstream run through a “column”, a large tube fitted with resins that remove specific particles unwanted from the final product.

Historically, pre-packed chromatography columns were practically non-existent - manufacturers were packing them in-house given the highly custom nature of how you pack a chromatography column. Repligen perfected this long before anyone else even entered the market, and kept its lead growing by adding technology from Atoll to create a more robust portfolio. Chromatography is the category Repligen has the most market share in today.

Process Analytics

Repligen acquired C tech in 2019, which sported a technology that measures protein concentration in real time. This by itself had a market need - quality control and process analytics were/are run asynchronously in most cases, and lots of data is still recorded into physical notebooks today. C Tech solves this problem, giving real-time analytics of the samples passing through the bioprocess. Since then, Repligen has expanded its potential, most recently with the Kroflo KR2i RPM, which adds in Slope Spectroscopy, which is effectively a better generator of more data than its predecessor, UV spectroscopy.

Isn’t she a beauty?

New Products Show It’s Only Getting Better

Repligen is still bringing exciting new systems to the market. Here are a couple examples that show how Repligen is both innovating and doing so in a way that positions well it for the future.

TFDF Systems & Filters

Tangential flow depth filtration solves the filter fouling problem of tangential flow alone with depth filters, a product that Repligen touts as one of its tools in service of the holy grail: a continuous bioproduction process. A continuous process (and the tools required) are ideal for any intensive filtration process, be it large-scale antibody or off-the-shelf cell therapy production. See below for more. Repligen is the only company with a competitive offering in this niche.

XCell ATF

There are multiple techniques for retaining the antibodies/cell/gene therapy products produced in the upstream part of the process, but one of the increasingly popular ones is alternative tangential flow, or ATF, because it works with methods that protect product quality, like perfusion. Repligen sells the pump that removes the permeate from the bioreactor, a key step in the ATF process, while blending in its real-time process analytics with a controller.

XCell is especially likely to help Repligen dominate in cell and gene therapy, where real-time analytics (or just more/better analytics in general) is key to convince the FDA that your product is being consistently manufactured via hard data.

Each of the products by themselves is cool, but what makes the Repligen suite special is that with real-time process analytics and continuous process-enabling tech, Repligen is likely to win at least a piece of business from almost every new bioprocess. If you’ve seen a company getting hit with a complete response letter (CRL) in the news, it probably has something to do with manufacturing issues. Repligen helps customers generate the data to prevent these issues from happening as well as prove it to the FDA.

This market need, especially in more advanced modalities, gives it the opportunity to bundle in a large array of other products that are sold more competitively by peers. This takes Repligen from a bunch of products to an actual solution, much like peers Danaher and Sartorius have done, only better.

The Holy Grail - A Continuous Bioprocess

The micro-trend that makes the above products so relevant is that they better enable a continuous bioprocess. This is important across all large molecules, but especially so with cell and gene therapy and biosimilars. Cell and gene therapies need continuous process components to support basic efficiency because the therapeutic cells don’t replicate efficiently enough. Costs are an issue here, but the big opportunity in front of us is biosimilars.

In just a few years, a LOT of the early biologic drugs from the past decade go off-patent.

These drugs will all face competition from biosimilars. However, large molecule drugs are far more complex and expensive to make than their small-molecule counterparts, with gross margins for the branded drugs at ~80%, often vs 90%+ in some small molecules (Merck, has a high-70s blended gross margin). Bluebird Bio even recently said it expects its gene therapies to have gross margins of as low as 70%.

Teva, a small molecule generics company, sports ~50% gross margins and ~30% EBITDA margins with no real growth or pricing power. With twice the cost of goods, it’s much harder to compete on cost. Generics companies looked to more efficient API synthesis to push COGS down to offset the much lower prices (this has made Divi’s Laboratories a very successful company in India), but it was easy to outsource API production because the bigger cost was headcount, and chemical engineers have always been much cheaper in emerging markets.

So how do you “genericize” your large molecule? In biologics, the headcount problem still exists, and is likely even more intense on the downstream end. With a paucity of qualified engineers who can support bioproduction and increased shipping costs (temperature controlling large molecules is not optional), the outsourcing decision is much trickier. What one can do, however, is minimize the need for human interaction with the bioprocess at all. This requires the tools that Repligen does best at offering. Repligen is likely already specified into most of the biosimilars coming in 2027/28 given its clinical mix combined with its 83% revenue exposure to antibodies ex-COVID.

Sewing it All Together with M&A - Repligen’s Operational Dream Team for an M&A Strategy

As a percent of sales, Repligen doesn’t spend that much on R&D - it’s no Illumina or Intuitive, nor does it need to be. Even if it did spend more on R&D, it would be extremely challenging for any bioprocessing company to invent innovative bioprocessing equipment at different steps in a coordinated way. Iteration is far easier. As such, Repligen has only had one way to fuel its ambition of being a large solution provider - acquisitions. But how does one guarantee M&A success in life science tools?

The answer is Thermo Fisher. More specifically, talent from the organization. The reason I don’t say Danaher is because in the case of Repligen, you want integrators. Danaher has been much more willing to let businesses it owns stay standalone, but Thermo Fisher deeply integrates almost every acquisition into its platform.

It’s no surprise Tony Hunt (CEO) has excelled so far. Tony himself worked at Life Technologies until its acquisition by Thermo Fisher in 2014. This was no small deal - Thermo paid near $16B for the asset, which could only grow that large with help from its own successful M&A efforts. In fact, Tony ended up at Life because he worked at a company that was acquired by the business (Applied Biosystems) earlier in his career.

The functional group leads also appear to have backgrounds at Tier 1 CDMOs, Big Pharma, or other large tools companies. The last time I saw a team with this deep a bench from the tools acquirers was Bio-Techne, which has also been a stunning success put together by a bunch of ex-Danaher people. Interestingly, Bio-Techne’s portfolio overlaps as little as possible with that of Danaher, likely to preserve the optionality of an M&A exit to Danaher down the road. Repligen is literally the same thing with respect to Thermo. It’s uncanny. These execs try to replicate their alma maters while respecting how difficult it is to compete with them.

Recap - Why This Year has Been a Sh*tshow for Repligen & Peers

If you haven’t already, I’d recommend familiarizing yourself with Repligen’s historicals as they’re likely to raise an eyebrow given how messy the past 18 months have been for Repligen and its peers.

Bioprocessing was how we produced mRNA vaccines and several drugs made to treat COVID-19. This meant a massive spike in demand for the manufacturing consumables. At the same time, zero interest rate policies spurred a massive spike in biotech R&D funding (I blame VCs), which happened to also be focused disproportionately on large molecule drugs.

Taken together:

COVID demand sucks up a large portion of manufacturing consumables, straining the supply chain.

To combat this, biopharma and CDMO businesses over-purchased these consumables (stocking).

These over-purchases at CDMOs were also based on the demand generated by the unprecedented number of large-molecule therapeutics candidates entering the R&D continuum.

However, on the other side of this, we have seen demand for COVID vaccines and treatments fall off a cliff, as has R&D funding, some of which was arguably funding questionable clinical candidates with low chances of success. So now you have the following:

COVID demand evaporates faster than expected.

CDMOs are left with inventory from COVID production they expected to be doing.

A high portion of the 2020-borne startups and/or clinical candidates cease to exist, removing CDMO demand from this segment of the market as well.

Mid-to-large-size biopharma companies also got lean by removing non-core programs, leaving them with excess inventory if they had manufacturing in-house.

Tools companies were blindsided particularly by the CDMO demand drop-off, as it was hard for the manufacturers to have visibility into the customer mix of the CDMOs, and the CDMOs were probably surprised by how much of their business was being canceled.

This one-two punch has created a 2-year headwind for Repligen and friends. The dropoff in COVID revenue was a high-single/low-double digit headwind to the business in 2022 and 2023. Furthermore, Repligen is guiding to a total revenue decline of 17-21%, with non-COVID revenue shrinking as much as 10%. This also has the knock-on effect of damaging margins, as Repligen and peers have built out extra manufacturing capacity to meet demand.

While it’s important to know what you own (and why sales went from up double digits to down double digits), I’d argue none of this matters. For the reasons I laid out above, Repligen is a well-run pure-play on an exciting end market with an innovation mindset that helps it out-maneuver its stalwart peers. The industry itself will eventually normalize back to growth, which I expect to happen as soon as next year. On the funding front, things have already been looking up!

Clinical Exposure - Benefitting from a Double-Edged Sword Coming out of 2023

There’s a reason the large cap tools companies’ bioprocessing divisions can’t grow like Repligen. Repligen is both smaller than Danaher and gets ~2/3rds of its revenue from clinical product processes (Danaher’s ratio is likely flipped). If Danaher won 100% of the “share” that avails itself in the market, which is mostly new clinical projects, the impact would be microscopic for several years.

This is because most of the revenue you earn when you win a sale in bioprocessing doesn’t happen in the first few years. You have to think about revenue as a number of doses produced - and in the clinic, this means the number of patients in the trial. Trials get bigger with each phase, with phase 2 being about twice the size of a phase 1 study on average. Phase 3 has ranged between 4x and 8x over the past decade, meaning the average enrollment for phase 3 is 8x-16x the size of its phase 1.

Commercial revenues don’t share a consistent relationship with trial sizes, but commercial volumes are both bigger and more durable than the trial revenue once a drug is approved. Repligen is at a size at which the combination of new clinical wins and drugs advancing in trials is enough to support growth that is above-market. If you think about what belies this, however, it could also mean that Repligen is taking an insane amount of share at the earliest stages. This revenue is effectively locked-in and will grow as drugs progress. It also means that contributions from drugs going commercial could be huge as well. Furthermore, there isn’t a lot of evidence to suggest Repligen will win less share of these new projects than it has in the past, given the level of innovation at the company and the lack thereof from peers.

Repligen has suffered more than peers due to the extent of its clinical mix, but as we return to growth, it is likely a massive advantage.

74x FY24 Earnings?! What I’m Smoking and How you Can Smoke it Too

I anticipate that a lot of value-oriented investors have puked and clicked away from this article, so kudos to those open-minded enough to still be reading. Given the above commentary on what COVID did to industry margins, it’s important to realize that most bioprocessing companies are likely under-earning for the next couple of years as they build out capacity to serve a level of demand we won’t be seeing again for a couple of years.

Under-Earning is (Somewhat) Obvious… But What is the Right Normalized Margin for Repligen?

There are two ways to triangulate what Repligen’s peak or normalized margin profile should be in the long-run: using its own financials, and available reference points from established peers.

Repligen Under-Earns Against Itself…

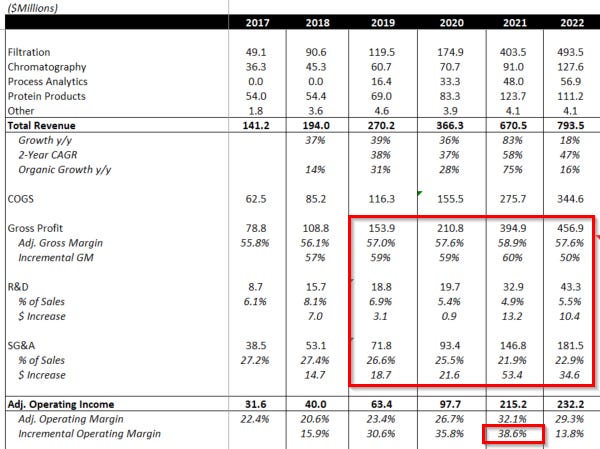

We should be confident that normalized margins are certainly higher than 2024 estimates, as revenue estimates for that year are lower than what the company was able to produce in 2022, a year where Repligen was still adding capacity to support demand that it expected to be at even higher levels than it has reached today. Nevertheless, RGEN had an incremental Operating & EBITDA margin of ~39% in 2021. This means that even during a period of significant investment, both on capacity and R&D, incremental dollars to Repligen came in at almost 40%. Furthermore, Repligen announced on its 2Q23 earnings call that it has identified cost savings in its current structure, which implies that inefficiencies were likely present in 2021 that further held back Repligen’s margin potential.

Note: Incremental EBITDA margin in 2021 was 39.2%

…As Well As Established Peers

We also have a sense of what near-peak margins look like at two of the incumbents, thanks to COVID practically maxing out said capacity briefly in 2021. In 2Q21 and 3Q21, Sartorius’s bioprocessing business put up a 37% EBITDA margin before we saw real headwinds from capacity expansions. Danaher enjoys the benefits of its DBS efficiency and its scale together, and while bioprocessing isn’t the only thing in its biotech segment, it reached margins in the mid-40s. This is not underheard of in tools. Bio-Techne did it in protein production, for example. Furthermore, all bioprocessing companies put through above-average pricing increases to “pass through inflation”, but some of those costs can reverse, permanently elevating the margin profiles of these companies. Repligen realized ~5% net price increases in 2022.

I would argue Repligen’s EBITDA margins could easily reach 40%+ at scale using peers as a benchmark because in 2021, the year when Sartorius’ bioprocessing unit did 36%, Repligen had a better gross margin by ~500bps (59% vs 54%). This may not be apples-to-apples because I’m an IFRS accounting noob and there’s some overhead I’m leaving out on Sartorius but it also wouldn’t be surprising as RGEN sells several products many consider to be more innovative and thus deserving of premium product status.

This all matters because consensus has Repligen doing 26% EBITDA margins in 2024, far below what I’d argue its true potential to be. With the above in mind, you can underwrite Repligen creatively in a way that makes the long-term thesis far more exciting without heroic revenue growth assumptions.

The Look-Through Math: Normalizing to Reasonable Multiples Without Heroic Assumptions

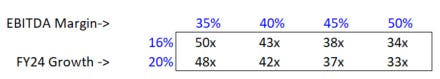

As margins expand to “catch up” to where they were/belong/can go, EPS growth will look inflated for a few years. You can model it out and see where you shake out with an exit multiple, or you can do so far simpler math to get something you can sensitize. I’m using a look-through analysis on Repligen to accomplish this. Here’s what your normalized P/E on 2024 street revenue looks like if you with normalized EBITDA margins of 35%, a level I find unambitious:

Note: Assumptions to get to adjusted EPS are depreciation=capex (3% of sales) and 20% tax rate. I gave no credit for the interest income RGEN currently earns on its net cash position.

Personally, I think I’m being too conservative on EBITDA margins, and that there’s a world where street growth for 2024 has gotten too low as well. Here’s how my simplified look-through P/E multiple sensitizes on those dimensions:

50x is still expensive on an absolute basis, but not when compared to comps - if you make this adjustment, Repligen is now only a slight discount to Sartorius (wholeco), and likely a massive discount to what an SOTP on WST/STVN implies for their bioprocessing-facing (proprietary products) segments:

Note: Sartorius is also under-earning its prior EBITDA high by ~500bps in 2024 ests.

Even if you believed that Repligen was going to grow 15% instead of the 18%-20% long-term guidance it gave out, Repligen would be growing its topline more than WST/STVN would be growing their earnings (assuming no upside to numbers), so even a consolidated premium could be warranted.

Getting Paid - Long-Term Hold Likely Required

All I’ve done above is justify the valuation. Hopefully I’ve done that well. But if you normalize the margins into the valuation, the return profile is limited to revenue growth + capital deployment as I’ve already baked the margin expansion into the look-through numbers.

Long-Term: The Cone of IRR Outcomes

I think Repligen can easily outgrow its end market by a few hundred basis points - let’s call it 15%. Management thinks it can do 18-20%, which would be 600-800bps above what I believe to be a 10-12% growth market.

If you assume that Repligen grows revenue 15% for 5 years, that margins normalize somewhere in that period, and that capital allocation adds 1% to earnings via M&A annually, you’d be looking at a ~16% IRR assuming the multiple doesn’t re-rate to a level more reflective of mature large-cap peers. I don’t think this is going to happen, but if it did make its way down to 30x, for example, you’d be looking at 5%. Sensitivity below:

One of the crazier ways to think about RGEN is that if you believe that it has the potential to scale to DHR margins in bioprocessing, you could be paying the equivalent of a mid-30s multiple for its organic revenue growth and future M&A.

In a lot of ways, I’d liken this story to that of Intuitive Surgical. The stock stayed “expensive” for the entire second half of the decade and remains so today.

Over the past 10 years, ISRG’s average forward P/E multiple was 42x. I’m sure there are countless stories in tech, but you see them in healthcare too. IDXX, DXCM, and ILMN all come to mind as well.

Short(er) Term: Market Could Let RGEN Keep its Premium When Growth and Margins Normalize

Repligen is already making moves to streamline its business. On its 2Q23 call, Tony gave a brief discussion of how he intends to “balance” the business, both on commercialization and on manufacturing inputs. This could bring margins back to highs faster than the street is modeling. Will the multiple stay the same, or decline because it was baking faster earnings growth? I think the former given the look-through math above.

Said differently, Repligen could surprise to the upside on margins next year and beat estimates by a wide margin. This could show up as soon as FY24 guidance at JPM. I don’t expect Repligen to give color on the 3Q call in a similar fashion to last year. If this happens, there’s a world where the multiple stays at a large premium and the upside is reflected in shares. For reference, a 30% margin vs expectations of 26% would produce upside of about 15% to shares if the multiple holds. There’s also a world where growth comes in much higher than 16% given the easy comps of this year and a normalizing funding environment.

Given what you could imagine the downside to be, however, I would not recommend a trading position in Repligen. It’s not obvious to me that we will get margin or revenue upside to street estimates next year, though I believe it’s more of a “when-not-if” scenario against 2025. Near-term, the risk-reward is probably pretty balanced given that multiple contractions could, in theory, hit much harder than compounded upside from revenue and margin expansion above estimates next year. If you can stick around for 18+ months, this is worth a look.

I personally do not have an opinion on the likelihood of the above outcome. This is a set-it-and-forget-it investment for me, and I’d welcome some short-term downside.

Risks - What Can Go Wrong?

This story is not without risks, and the stakes are high given the optical multiple Repligen trades at today. Here’s a non-comprehensive list of things that can go wrong with the Repligen story:

Stocking dynamics continue to last into 2024. Not impossible, but some of the math stops making sense if you try to assume stocking lasts past the first quarter of 2024, and easy comps make life easier for the tools companies. The pushback I’ve gotten on this is that in 2000 and 2015, both of which were big biotech bubble explosions, it took 2-3 years for a full recovery, the latter timeline being shorter. I believe this is because biotech investment is increasingly venture-ized vs the past, which has to put a lower ceiling on recovery time because you can’t expect VCs to invest zero dollars for very long - their careers depend on it. COVID also made the “down” part worse than in prior cycles, so the comparable should matter a lot more this time around.

Multiples in life science tools or healthcare as a whole fall. It happens. Diversify. Personally, I think GLP-1s drive a secular rotation away from certain categories in medical devices and healthcare facilities because they have the potential to damage the terminal value of almost everything in healthcare outside of the biopharma sphere. This would act as a rotation into tools and pharma services, not out. The relative safety change could improve multiples for tools.

Small molecule discoveries continue to prove effective at treating diseases previously thought to be treatable only with biologics. It seems that small molecule innovation isn’t done yet, even if the investing world has shifted to their larger counterparts. I don’t expect too much more from small molecules in the way of breakthroughs, but I can’t ignore all the work still being done and the potential for AI to break barriers we didn’t know existed in this space. The other side of this coin, however, is the IRA and the disincentive to invest in small molecules it has created. This is another risk you can hedge by diversifying into other parts of the pharma supply chain.

Biosimilars broadly end up being a flop. Many people equate biosimilars to generic small molecule drugs, and in a properly functioning healthcare system, that needs to be the case in the long run. However, early data suggests that Humira, which went off-patent this year, is seeing limited impact from competitive entrants with biosimilars. It’s not totally clear to me (and others) why this is yet, but if it’s because the similar in biosimilar makes it harder to adopt the cheaper alternatives without longer-term data than provided in trials, it could deprive Repligen of a lot of the upside that makes the investment case for the company so special.

FDA regulations on bioprocessing loosen, enabling knock-off products and price competition. Geopolitically, this seems impossible as it invites the incoming crop of Chinese tools providers a way to ruin US/EU businesses with little benefit to the healthcare system. Repligen’s product suite is also harder to replicate than the plastic-heavy portfolios of the incumbents.

Competitors bring products into niches Repligen enjoys a monopoly in and share gains become more scarce. This would happen slowly, and the “spec’d-in” nature of existing workflows make this an unlikely story to play out in a way you couldn’t see coming a mile away. Furthermore, there isn’t a demonstrated R&D mindset at either Danaher nor Sartorius from a management perspective, making the biggest threats to Repligen competitively unlikely to become more threatening.

Repligen starts doing larger M&A and overpaying for it. Repligen has done a great job of restricting its M&A to tuck-in size, so the stakes have historically been pretty low. However, there is nothing in management’s incentive package that prevents an Avantor-Ritter mistake if Tony and the team shift focus and start getting aggressive. Given the Thermo Fisher DNA at the company, I find this unlikely, but it’s worth watching out for. Below was management’s targets for 2022:

Put gently, there is a lot of implicit trust in this compensation scheme. There are bonuses given to group leaders for specific operational M&A integration accomplishments, but nothing forcing management to focus on ROIC, deal ROIC, cash flow conversion, etc., despite management coming from an organization that is all about these things. I worry that the street would become very skeptical very quickly if Repligen had any missteps here, but I don’t expect those missteps to happen at all.

Conclusion

I hope that you enjoyed this writeup as I am a large fan of the business and have gotten a lot of questions about it on Twitter/X. It has been a wild ride this year, and I’ve focused a lot of attention on trying to “time” my opening of a position in Repligen. I failed, but also don’t feel like I missed the opportunity altogether.

For those interested, there are lots of other ways to pure-play the cell & gene therapy components of the space in SMID land - I’ll probably talk more about this and why I don’t do it on our favorite digital town square.

As always, please feel free to leave feedback!

Really enjoyed this, thanks. Looks like you timed your purchase well, though today action interesting (TMO/DHR too - can't see why).

Great poast, this was captivating.