Introduction

As I begin to write this, the entire bioprocessing space is moving up on commentary from Sartorius suggesting that the “bottom is in” for bioprocessing. I’ve talked a lot on Twitter about healthcare and the life science supply chain; bioprocessing and biologics CDMOs have been the biggest battlegrounds among them. More broadly, however, I’ve posted a lot of and spoken to a lot of people personally on the healthcare macro since I started The Borlaug Report and thought it’d make sense to get all my thoughts from the year in one place and talk about how they’re changing. Much like any other sector, it's easy to take a top-down approach to stock selection if you know which hunting grounds are the best. I think these “grounds'“ have changed a lot since the start of the year.

The tl;dr is that I think it’s time to get long bioprocessing companies given all the new information we’ve seen over the past few months, and avoid new positions in most of the other types of tools companies. Before we get into that, I want to talk about the healthcare macro a bit. I think investors underestimate how many ways to play healthcare and life sciences there are. There’s always something to do, long or short.

This is a new type of note I may include periodically as my thinking evolves over time. Would love feedback from readers if you find this at all helpful to mix in with the usual primers and pitches.

Positioning in 1H

From the beginning of the year until June, the healthcare macro positioning (short-term) I had been advocating for at various points in time has been as follows. I’ve included a little rationale on each.

To be clear, I was not long or short most of these names - these are areas I point generalists to and hunting grounds for my own (mostly long) ideas, which as a current individual investor can include smaller-cap names than the basket samples I’m laying out below. I’m generally long-biased in my personal account and the bar for a short is pretty high. Feel free to reach out if you want to talk about specifics.

Long:

Large, Clinical CROs (IQV, ICLR)

Medical devices (STE/EW/BSX/ZBH/SYK)

Labs (LH/DGX)

Insurers (UNH/ELV/HUM)

Drug Discovery Platforms (TWST, ABCL, EVO, OABI, RXRX, EXAI)

Guiding principles:

Both large clinical CROs have 2-year+ backlogs, and the ability to practically choose their customers, there was/is little risk to numbers. Low multiple + little risk to numbers.

Procedure recovery was an emerging theme at the beginning of the year, and I expected this to spill over to labs while also being captured in the pricing of the managed care, creating the opportunity to “hedge” by owning both procedure-based names and MCOs.

With rates at long-term highs, the royalty aggregators seemed extremely cheap even if you put a per-program floor valuation on them like I did in my Twist writeup. Kind of like owning a more diversified XBI.

Watching from Sidelines/No Major View:

Traditional Tools w/ Lower BP & China Exposure (TMO, BRKR, RVTY, BIO, TECH)

Large CDMOs & Preclinical CROs (SWX:LONN, CTLT, CRL)

Fill-finish tools (WST, STVN)

Short/Avoid:

Bioprocessing Companies (RGEN, SRT/DIM)

Smaller omics tools (TXG, PACB, SEER)

Tools w/ too much China/industrial exposure (MTD, WAT, A)

Guiding principles:

Market was underestimating the bioprocessing industry’s exposure to biotech funding. Both COVID and this dynamic compound stocking issues. Multiples and numbers were too high.

Too many next-gen technologies competing for funding dollars in 2023 (or at least, that was the view). Hard to find room for upside when sales cycles lengthen especially if new tech ultimately wins those cycles at the margin.

I don’t think China tools are coming back in R&D land given geopolitical tensions. Too easy for the government to engage in IP theft/support an ecosystem of cheaper knock-off suppliers, which appears to be happening.

Industrial exposure seems logical to avoid given the looming potential for a recession. Healthcare and life sciences are supposed to be defensive, why risk losing that benefit in 2023?

Note: there are more sub-industries that I simply haven’t been watching, like distributors, facilities, and HCIT. Perhaps I should expand my aperture, but this year I haven’t struggled to find ideas within the above spaces.

How’d 1H Go? A Look at the Baskets

I’m mostly writing to discuss how I’m changing my thinking on positioning throughout the year, but first it’s probably important to talk about where I was right and wrong so far.

Things are fluid, most of these views were conceived, evolved, or even played out during the first three months of the year. For reference, however, here’s how the above baskets played out from the start of the year to 7/20:

Overall, the large cap healthcare macro was pretty straightforward YTD, and I think I got it directionally right. The “longs” went up, the “avoids” went down in large cap land. I think I got labs wrong, but stand by managed care. Where you could have gotten in trouble was by shorting anything tied to the violent moves in sh*tco land. I happened to benefit a couple times on the long side this year. Fun to be right, even if for the wrong reasons!

Time to Change Positioning

A couple weeks ago BofA did some work on positioning as well. The findings were that institutional investors were positioned as follows:

This work shows that over the last 3-6 months, several of the sectors I’d advocate for as long and short ideas have become consensus. CROs don’t seem to be present in the analysis, but the price action suggests they’ve become more of a consensus long as well. As such, I’m rethinking how I position for the rest of the year.

Medical Devices & Labs: Quit While Ahead

The large medical device businesses now seem fully valued as a category. This is a sector where there is always a dislocation or two, much like in tools.

Medical devices worked because:

Staffing and inflation fears had kept a lot of investors out of medical devices (no pricing power = margin headwinds) over the past year.

The former started to resolve itself at the beginning of the year and hospitals started working through a large backlog of procedures.

With the key revenue bottleneck out of the way, the device companies were able to surprise on revenue and scale economics drowned out the remaining inflationary pressures (which were being lapped).

Today, however, devices are probably a little trickier to own. Procedures coming back is a well-appreciated trend, so the bar is higher. Look at ISRG today after an excellent quarter:

Expectations got sky-high on procedure volumes, and even a 400bps procedure growth beat wasn’t enough. I think this is emblematic of how well-understood the return-to-hospital trend is. I’d advocate for taking chips off the table. For reference, the group trades about equal to the tools group at the median, and I’d argue tools companies are much better businesses long-term (pricing power, competitive moats, FDA/CMS risks).

6 months from now, all eyes will be on 2024, where we will be lapping these big recoveries. Nobody likes decelerating growth. What could make this worse are the GLP-1 drugs, which if widely-used enough have the potential to slow down hospital visits, removing certain high-acuity procedures.

Where I think the opportunity still exists in devices, however, is where there are more single-product stories that investors don’t apply macro to as much. I’ve pitched PRCT on Twitter and am continuing to hold it, for example.

On the labs front, what I think I got wrong was that collection facilities had no such bottlenecks as hospitals, and the incremental hospital-driven sample volumes aren’t moving the needle. Both DGX and LH trade slightly above historical averages on forward numbers, and don’t offer enough growth to get anyone excited without some upside surprise in numbers. While I’m not “ahead” here, I’d move to the sidelines anyway. The genomics labs, like GH and NTRA, seem to have captured this benefit much more effectively, however those names have run as well at 39%/20% YTD on revenue surprises.

Clinical CROs: Still Some Room to Run

The easy money was definitely already made here, but IQV and ICLR both trade at 21x/19x forward EPS with little downside risk to numbers. That’s a hell of a deal for capital-light companies that grow high-single-digits at the topline that are expanding margins/deleveraging. I’d stick with them, as I could write a whole article singing the praises of the quality of both IQVIA and ICON.

Managed Care: Still Seems Hate-Sold

UnitedHealth, Elevance, and Humana are all high-quality businesses, and health insurance is still an attractive oligopoly for long-term investors to own. Given forward multiples, even the post-UNH earnings move, the payors are still out-of-favor in a way that seems unjustified for a long-term investor.

The reason for the fear, for those interested, is a combination of regulatory (Medicare rules etc.) and the other side of the procedure trend - UNH and friends lose money when medical costs are higher than expected. However, they also use historical trends to inform pricing, which means that while this year might have some choppy MLR (medical loss ratio) numbers out of these guys, next year could just as easily be better as a result.

Bioprocessing Tools: Time for a 180

About a month ago, I posted the following, and I meant it:

The tools industry held a status as a consensus short heading into earnings, and bioprocessing was the source of all the downside estimate revisions. Sartorius reduced its guidance in June, crushing its stock price and further dampening sentiment that things would continue to get worse. However, for the same reason I was pitching it short, investors were clearly overlooking the underlying growth drivers:

Funding data shows improving investment, which drives a lot of the end-market growth:

Several large-TAM drugs are being launched over the next 12 months, including one for Alzheimer’s, creating multi-year demand tailwinds.

One of the larger CDMOs in the toughest geography, Wuxi Biologics, called out that it had about 9 months of inventory to work through in June (at a GS-hosted event), implying that the worst country from a destocking perspective would be back by March. Not crazy to think that the US and Europe come back to growth sooner than China.

Wuxi has most of the outsourced manufacturing capacity in China, making it an excellent barometer for China-specific macro.

Frankly, I thought the space had further to fall before last month, just given how expensive the pure-plays have managed to stay. What I got wrong on the short call was how willing some portion of investors were to look through to the long-term secular growth thesis. If you shorted Repligen in March at $180+, for example, you didn’t have very long to cover the couple of times it dipped below $150. I’d hardly call that a massive success.

However, it’s also clear that a lot of investors were (and probably still are) on the sidelines, too. Taken together, I think this is as good an entry point as anyone will get for most of the bioprocessing space.

The Other Tools: Buyer Beware

The outlook for the rest of the life science tools end markets, on the other hand, is not so rosy. Industrial end markets are exposed to recessionary forces, academia could fall off a cliff next year, and small-molecule-focused tools are not getting a lot of love at biopharma companies for R&D and quality control purposes. As I’ve mentioned before, I also think China revenues are in jeopardy for the companies that are not living in bioprocessing land. The industrials/recession bit is obvious but I’ll elaborate on the others.

NIH funding Overhang

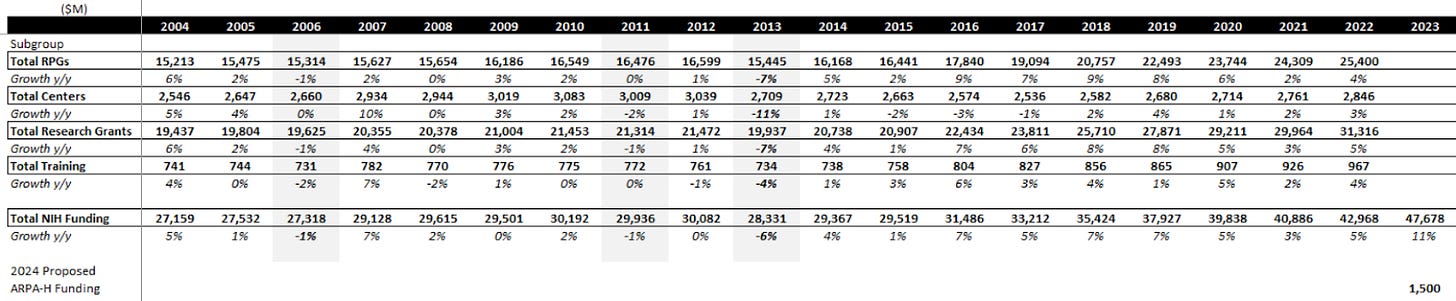

I harped on this in my last article, but I think it deserves repeating - the debt deal that was signed in June is incredibly ominous. The deal we signed freezes all non-defence spending in aggregate. This means that total discretionary spending in aggregate must remain the same, but individual agencies can still grow spend - it just has to be at the expense of other ones. Assuming no agency takes from others, this is already worse than the ~HSD increase the NIH (which is said to account for 20-25% of all research funding in the US) was going to get under Biden’s proposal in March.

What is even scarier, however, is the GOP proposal:

In 2023, the NIH was ~41% of HHS's $112B discretionary budget authority. HHS is 54% of the category you see above. If you assume that only half of the $60B cut happens (some type of compromise) and is proportionally distributed to labor, HHS, and education, that’s $16B cut out of HHS and $6.6B cut from NIH specifically vs 2023 numbers. This would be a 14% y/y decline, the largest in NIH history, and one of only 3 cuts since the 90s. There are a lot of unknowns today, but a 14% headwind to 25% of academic research takes 3.5% out of an end market that usually only grows about that much annually. In my mind, this is a growing tail risk in a period where academic market growth has been running hot in the US.

The other scary part is endowment funding for research is probably running tight as well given negative market returns last year (assuming most universities had similar performance in aggregate). Combined with the VC/alts meltdown, there are lots of reasons to think we could have a bumpy couple of years for academia.

Here’s what happened to traditional tool company stock prices in 2011, the year that we observed the first negative shock in research grant dollars after 4 years of growth:

The shift toward an “anti-science spending” from the NIH impacted the whole space, most of all the academic-tools-heavy companies like TMO/BRKR/PKI. The last time we had negative NIH budget growth was 10 years ago. This could be a huge end-market shock, as our reliance on NIH for R&D funding growth has risen a lot since 2013.

Pharma Not Buying Lab Tools for Small Molecules?

The below is from Cowen following a dinner with Agilent’s CFO:

The alarming piece is that pharma seems to be elongating spending cycles on capital. In addition to “macro concerns”, customers are citing IRA uncertainty. The pharma industry appears to be forming a view that investment in small molecules at least partially depends on the outcome of the lawsuits being filed to shoot down the components of the IRA that talk about drug pricing, specifically the 9-year exclusivity period for small molecules (biologics get 13 years before pricing gets crushed by Medicare’s “negotiation” policy in the Act.). Uncertainty here is a near-term risk to the traditional tools companies.

China Tensions - First Search Software, Now Spectroscopes?

When COVID hit, China shut down like everyone else. So did its R&D tools market - growth turned to vanishing revenues quickly for most companies. What has been weird since, however, is that growth hasn’t exactly been roaring back. At the same time, geopolitical tensions are on the rise, and a domestic Chinese life science tools industry seems to be appearing out of thin air. We’ve all seen this movie before. Tools got too profitable - and China likely would rather support a domestic industry selling regulated plastics and chemicals for 25% operating margins than let the likes of Western economies benefit.

Below is from a McKinsey survey of Chinese companies about providing tools:

The above shows that China’s ambition to compete more directly in the life science tools market is obvious. What is debatable is whether or not Chinese knock-off providers of tools will ever gain real traction, especially in highly-regulated segments of tools like bioprocessing, in developed markets. What is obvious, however, is that foreign providers to China all have their China sales at risk right now. I think that over time, the “slow return to growth” starts being proven out as a myth as some of this behind-the-scenes action becomes more salient.

Taken together, I’m pretty nervous about how things are going to go for the traditional tools companies next year, whereas bioprocessing is lapping a tough year and the specific inputs that drive it are improving rapidly.

2H Positioning: More Sidelines, More Bioprocessing

There are single-stock opportunities in just about every sector in healthcare still. However, if you’re looking for a new position, the hunting grounds have become less plentiful (but where haven’t they, given the rallies we’ve seen across the market?). Based on the above, here’s what I’m thinking makes the most sense given how things have moved around:

Long:

Clinical CROs

Insurers

Bioprocessing Companies

Neutral/No Major View:

Medical devices

Labs

Large CDMOs

Preclinical CROs

Fill-finish tools

Drug Discovery Platforms

Short/Avoid:

All non-bioprocessing/FF tools

The rationale is simple - most of the obvious sector-level longs seem well-recognized, and valuations reflect it. The only “expensive” sector I’m advocating for is bioprocessing, which arguably deserves a premium but comes with the added benefit of having a secular megatrend behind it and seriously negative sentiment dampening the space ahead of earnings.

The CROs/Insurers are still more straightforward, in my view. Both have seen improving signs of optimism, but valuations remain pretty palatable, if not attractive, especially relative to the alternatives.

Many of the drug discovery platforms have re-rated heavily on the latest risk-on and AI news-driven moves, and I’m not longer confident that these are easy investments to underwrite for the next 6 months. Long-term investors should probably still consider some exposure here, in my opinion, but the space as a whole is not as obvious after a 37% YTD move.

Conclusion

Hopefully you found this helpful. While the tone of the note may sound more short-termist in nature, I see no reason that one can’t benefit from understanding the climate of the sector he/she is walking into when looking for a new idea.

To be clear, I am not advocating the sale of any long-term position here. If you trade more actively, or take a more opportunistic approach to investing, feel free to consider the above but do you own research on each individual name. I own long-term positions in medical devices, drug discovery, and traditional tools, all of which I’ve either “downgraded” since the start of the year or would recommend others avoid until certain risks dissolve. There are probably some fancy short-term moves one could make on both the long or short side today, but I’ll leave that to the long/short guys with all the resources to make those decisions.

As mentioned in the intro, please feel free to message me with feedback on this type of piece, as I’m weighing it against more single-stock pieces.

Where is the biofunding data coming from?