#12: Let Me Do It for You (CRO Primer)

The Boring Businesses Dislocated by Vibes and Science Jargon

Introduction

The past few weeks have been a constant injection of geopolitical uncertainty into the markets, which has sparked debates about US recession, global inflation, and a litany of other tensions. Normally this is exciting for a healthcare analyst.

In past times of uncertainty, healthcare has been go-to, safe-haven sector in a generalist’s portfolio. That’s still true today, but only if you add a few filters. The problem is, ironically, that there are so many of these filters you need to add now that it makes most of the sector look like it isn’t defensive at all.

The market largely appreciates this today at a high level, but there are nuances within each sector and sub-sector underneath. There are businesses in many of these sectors that should do well (or better-than-feared) in every combination and permutation of recession, tariff, inflation, or rate risk scenarios you can come up with.

One sector that, in my view, has had some babies thrown out with the proverbial bathwater is the contract research organization (CRO) space. My hope is that this article serves as a primer for the space that is both balanced in terms of evaluation fundamentals, but also shows why I think there are some opportunities, especially for those looking for deep-value-esque situations.

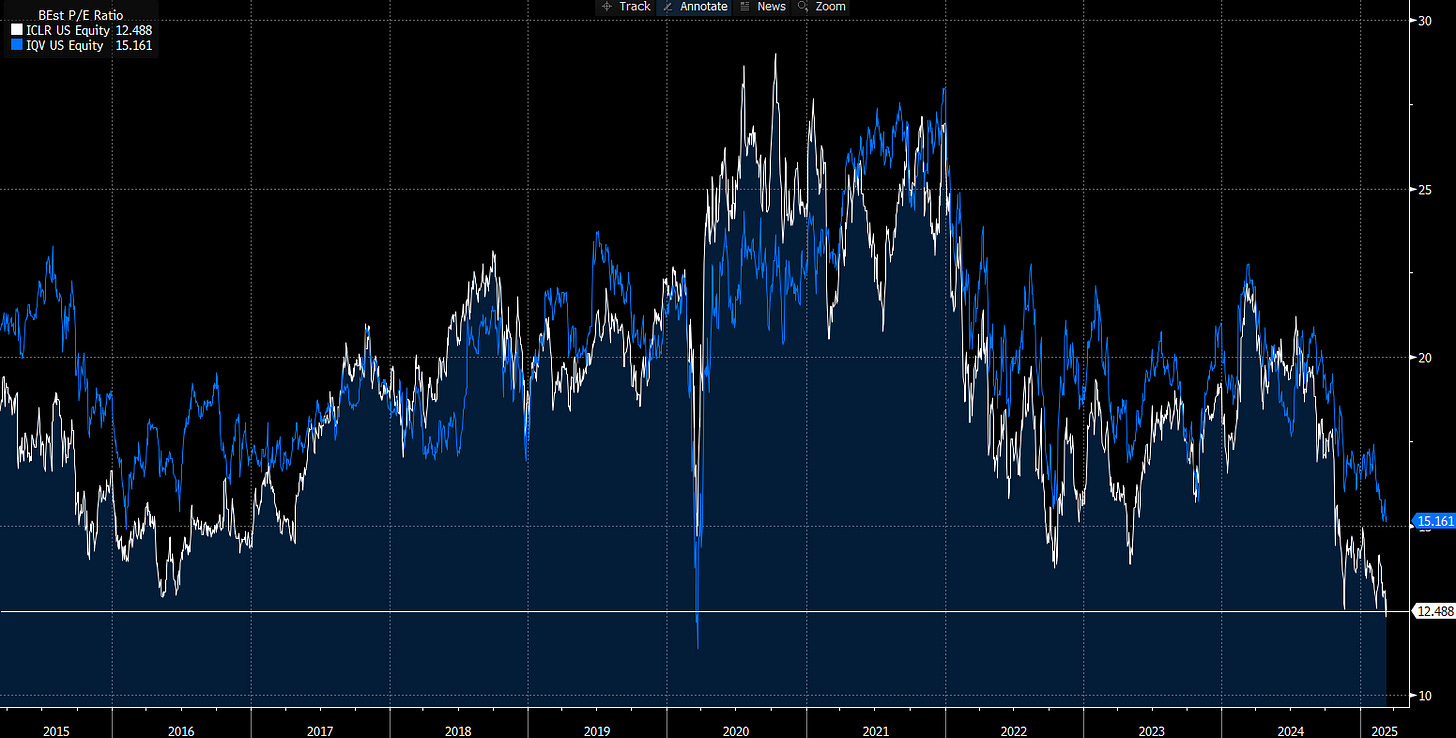

I won’t bury the lede - the below is a Bloomberg graph showing historical NTM P/E valuations over the past decade for the 2 largest publicly-traded clinical CROs:

At 13x/15x, ICLR/IQV are trading at/near all-time lows from a valuation perspective. Granted, there are some differences in the environment vs the last time we reached these levels, but if you account for them, these levels seem more dislocated, not less.

In 2015/16, the industry was exiting a biotech bubble explosion, with the XBI bottoming out in early 2016. IQVIA was formed in 2016 via the merger of IMS and Quintiles in 2016, a deal that was universally hated at the onset, until the combination proved synergistic over time. The CRO industry has also consolidated significantly since this period. The offset is that outsourcing tailwinds supported faster growth at the time than they might going forward, purely as a function of maturity.

The 2 above are businesses with 1) secular topline growth drivers that support MSD% organic growth or better, 2) a plethora of capital deployment options at their disposals, which supports 3) ROICS of ~HSD% with future upside potential, all of which pave the way for 4) long-term EPS/FCF growth potential in the low-double-digits.

Should any company with such characteristics trade at a 25%+ discount to the S&P 500? What about when they’ve also traded at parity or a premium in the past? Perhaps not, if you believe that those characteristics don’t exist, or that they come with excess risks. There are plenty of open debates in CRO land, but the magnitude of this gap is hard to ignore.

First, it’s important to reflect on how we got here, to an environment that abandons entire sub-sectors and crowds others based on high-level perceptions of fundamentals rather than nuanced ones.

Why Healthcare/Life Sciences Doesn’t “Feel” Defensive to Investors Right Now

Hospitals, managed care, medical devices, and pharma are all great places to park your dollar when you’re worried about a US recession and a shifting geopolitical landscape. In theory.

The former two almost exclusively serve the US healthcare system, insulating it from the likes of tariffs and the government sleeves of insurance increasingly blunt the impact of recession-driven unemployment that would otherwise affect coverage, especially relative to 2008. The majority of US healthcare spend also lands in the 65+ population which today is effectively 100% Medicare.

The latter two serve healthcare more globally, opening up the tariff debate, but enough of the manufacturing footprint to support these spaces are local (or can be within a year or two), and the majority of revenue for both still goes to the US. Higher costs are passed on to customers and absorbed by insurance. The employer or taxpayer, who covers most of the insurance premium, then foots the bill. If pharma sales grow, spending should grow too. In theory.

However, there’s hair on almost every subsector today. US providers/hospitals and managed care benefit from pockets of federal spending on Medicaid that is now at risk under the new administration, with possible subsidy cuts and stricter enrollment requirements threatening participation in insurance altogether. Biopharma is faced with its own problems - upcoming IP expiries (LOEs) threaten >$200B in industry sales for big pharma. Uncertainty has been high and persistent enough to affect biotech capital markets. Academic and government R&D growth is facing secular risks for the first time in recent history given how reliant it has become on federal and the fears that this funding won’t be as plentiful. These make it hard to own life science businesses.

In effect, this leaves you with medical devices/supplies, diagnostics, and distributors. Lo and behold, these are the crowded trades today. LOE risks are isolated to a handful of big players, so well-positioned pharma companies for the LOE environment have done well YTD (GLP-1 drugs are a nice thing to be selling today as well). Managed care companies levered to Medicare Advantage are crowded relative to those levered to anything else in the space, but the whole space has held up well since the headwinds we are lapping across both MA and Medicaid were arguably far worse than any of the funding cuts could be to the space.

Everything else is largely left for dead - the median performance of the R&D tools/bioprocessing/packaging/CRO/hospital names in my watchlist groups are (13%)/(2%)/(8%)/(8%)/(5%) with a very negative outlier skew. Some of this is justified, some much less so. XBI is (6%), which is a tragedy given the amount of pain biotech has endured in the years prior.

Bioprocessing and packaging fundamentals are largely driven by various types of drug production volumes rather than drug sales, so you’d think they’d have performed better, but they are still emerging from a multi-year period of headwinds, COVID-related and otherwise. If you’ve been reading my work this year, you know where I stand on these.

I believe this has created a strange but advantageous stock picking environment. I know what you’re thinking. The sell side says this every year in the outlook pieces, even if historical data tends to back the idea that most managers outperform on sector rather than individual names. I roll my eyes just as much as you do when I see this.

However, if my interpretations above are correct, it would suggest the market has indiscriminately abandoned most of life sciences which, in my view, has created an abnormally-large number of valuation dislocations. For example, bioprocessing and packaging companies sold off when the NIH drama first flared up despite ~0 exposure. A lot of the largest dislocations I see are in the CRO space, which is the focal point of this article.